Overview of Earnings

I have earned ₹600, but as you can see, the balance shows ₹900. This is due to some extra earnings I got from referrals and other offers in the app. In this video, I’ll explain how you can also earn money by completing these tasks and offers.

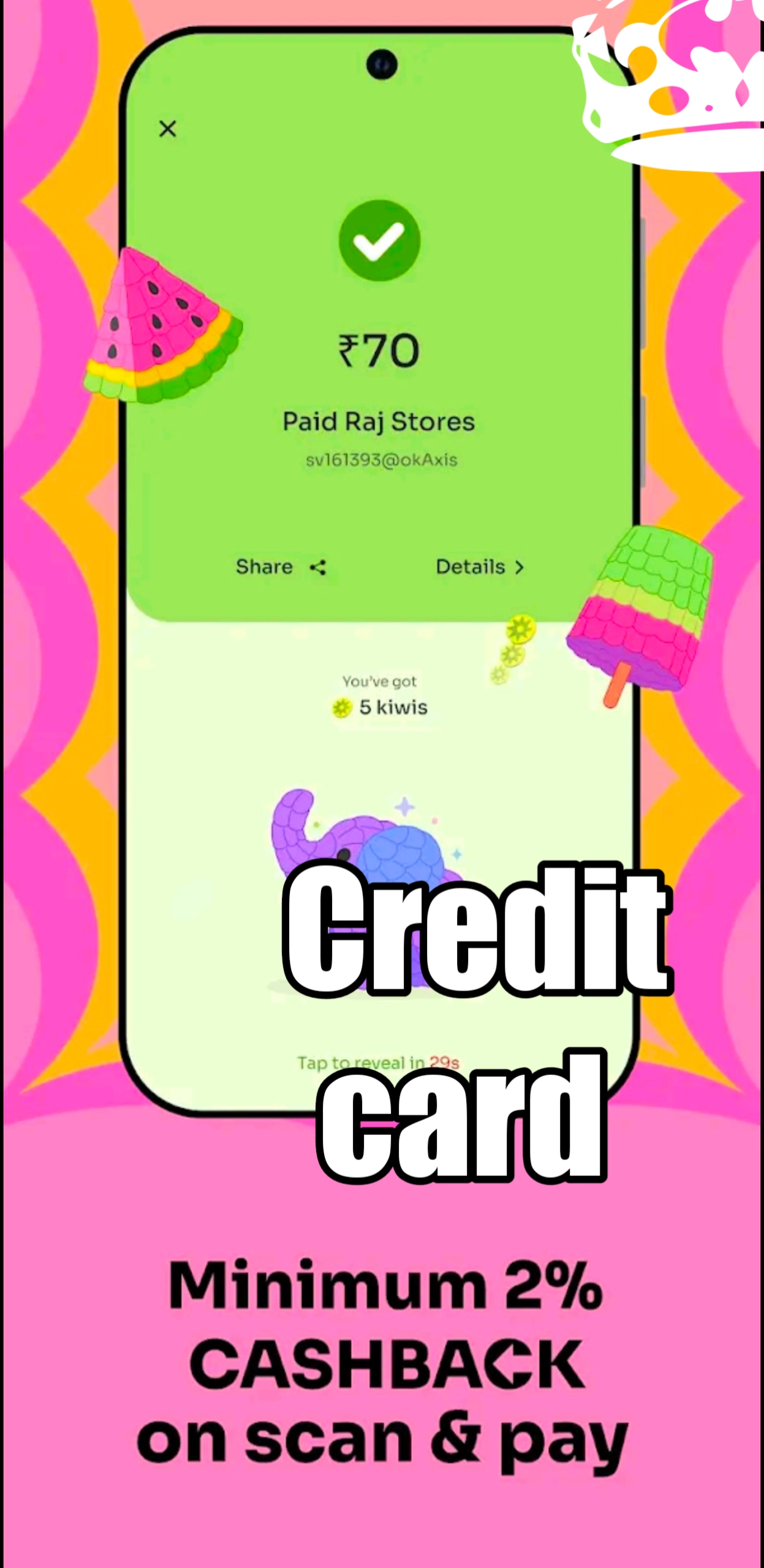

So far, we have claimed Kiwi worth ₹07. Let me explain all the ways you can earn and the criteria involved.

Getting Started with the App

When you open the app, it asks for your mobile number and PAN card number. Once you provide your PAN card details, an interface will open in front of you. On the homepage, you'll see an option to "Spread the Love" and invite your friends. There is also a "Refer Now" option which you can use to invite others.

Referral Program Details

If you are referring people to earn money, make sure they add their credit card to the app. You will receive a flat cashback for every transaction made by your referrals, provided they have linked a credit card to the app.

Additionally, if you have a Rupee credit card, you can add it to the app and receive cashback every time you make a transaction. It's a simple process to link your credit card and start earning money.

Other Features in the App

The app offers more options, such as managing your account and checking your credit score. You can link your credit card by clicking on the “Continue” button in the app to apply and add your credit card to the Kiwi app.

Bank Account Integration

The app also provides a scanner option where you can add your bank account details. Once your bank account is added, you can perform transactions and earn rewards from them. This feature is designed to help you track all your financial activities and earn money seamlessly.